Esop cash out calculator

Building value for our employees clients vendors and project teams since 1882. The calculator shows you what the cost of your transaction might be and the associated tax benefits.

Safe Calculator For The Y Combinator Post Money Safe

Years to project growth 1 to 50 Current annual salary Annual salary increases 0 to 10 Current.

. Simply complete the form to request a free Estimated ESOP. If the shares of a listed company are sold within a year of having acquired ESOPs the employee will be subject to short-term capital gains tax of 15. When can you cash out ESOP Once you turn 595 you have the option to withdraw money and avoid a penalty although the distribution will be at regular income tax rates.

Identifying Penalty Exceptions If you. Enter the current balance of your plan your current age the age you expect to retire your. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation.

Age at retirement Age you. If you take out 20000 you must add that extra 20000 to your taxable income for the year and a 2000 penalty on your taxes that year. The share portion may be cashed in so you will get cash for.

You can test out assumptions for your situation using our calculator. ESOP tax calculator India in excel you can edit use it according to your need. 33 50 State income tax rate 0 6 13 20 Cash Today vs.

The calculator inputs consist of the retirement account. You can also send suggestions updated. This cash out calculator can be used to estimate the gain or loss when cashing out a retirement plan such as a 401k or 403b account.

Using this 401k early withdrawal calculator is easy. The company can preserve cash and dilute ownership if required. Value is the difference between the fair market.

Your Annual Account Statement By law your company must send you an annual statement reporting the amount of cash and stock in your ESOP account. Savings at Retirement Taxes Penalties Lost Interest Definitions Current age Your current age. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

Esop Payout Calculator Currently ESOPs are taxed because employee benefits wage income are in the hands of employees. Many ESOP participants leave with an account that has both stock and cash in it. While it may seem tempting to cash out your retirement plan money for emergencies or short-term expenses know that you could lose a significant portion of that.

You do not need to. Use this calculator to estimate how much your plan may accumulate in the future. Tax STCG tax per cent.

The cash will be paid out in cash. While each situation is different an ESOP transaction could take place as soon as 90-120 days after starting the process. Using The Calculator And Comparing The Results.

If you are under 59 12 you may also.

Option Price Calculator American Or European Options

Startup Equity Value Calculator By Triplebyte

Retirement

Free Startup Equity Calculator Evaluate Your Equity Offer Carta

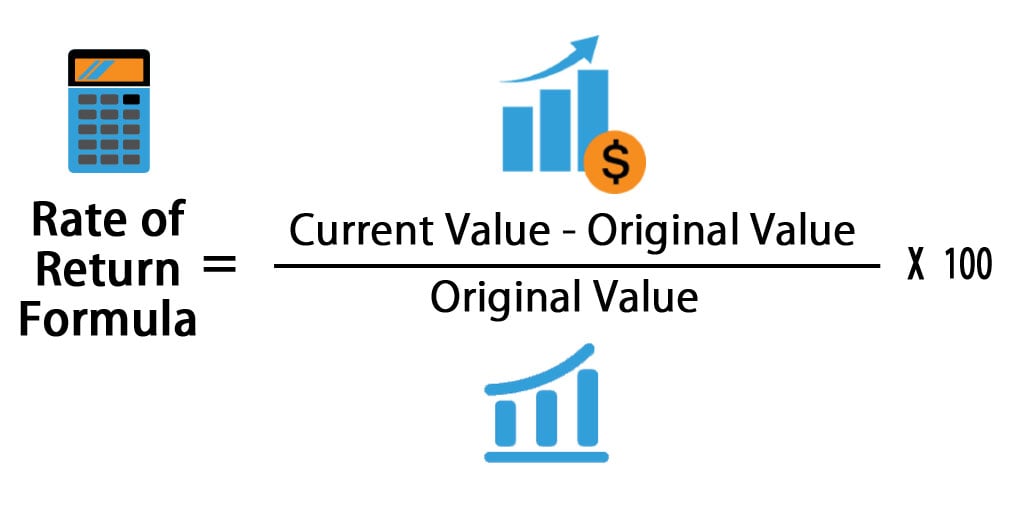

Rate Of Return Formula Calculator Excel Template

Hyperinflation Effects Of An Uncontrollable Inflation Hyperinflation Bank Lending Economy

Calculating Diluted Earnings Per Share

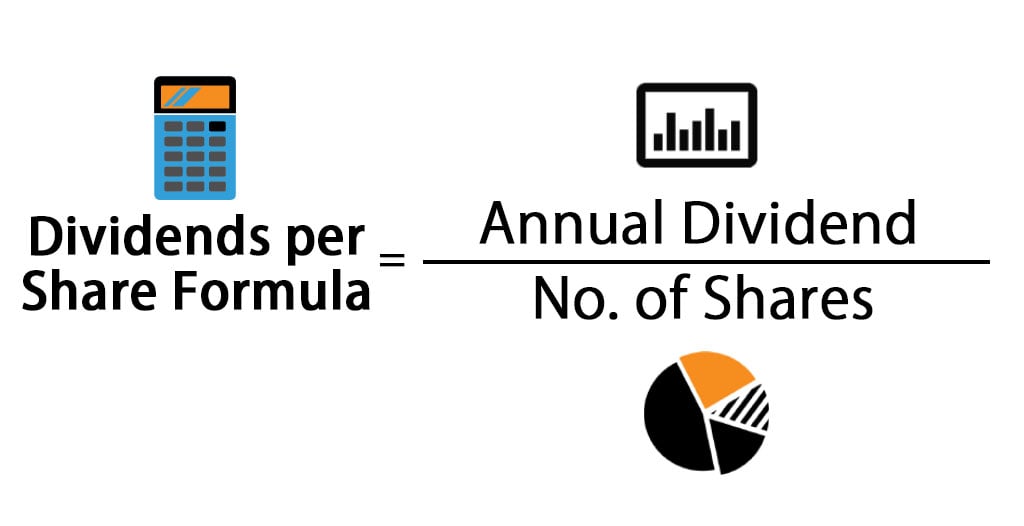

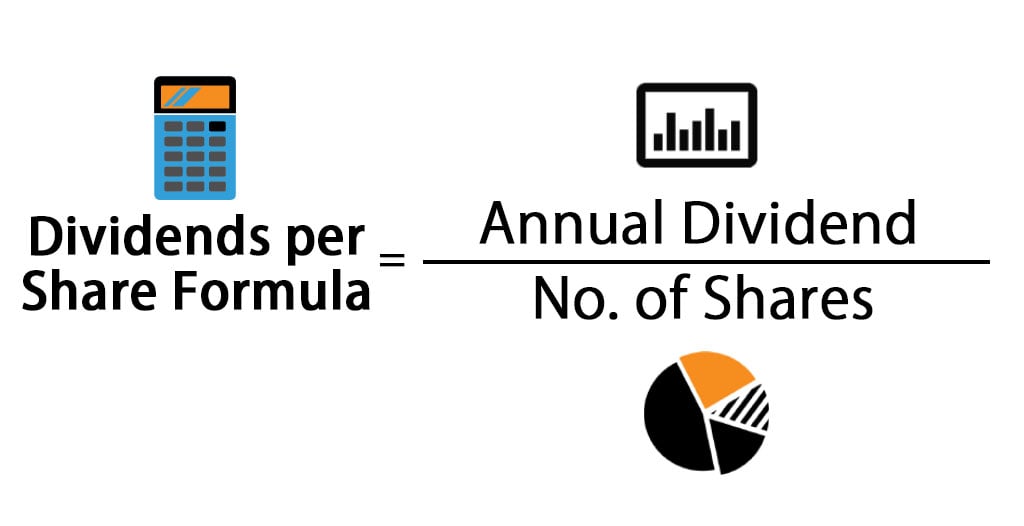

Dividends Per Share Formula Calculator Excel Template

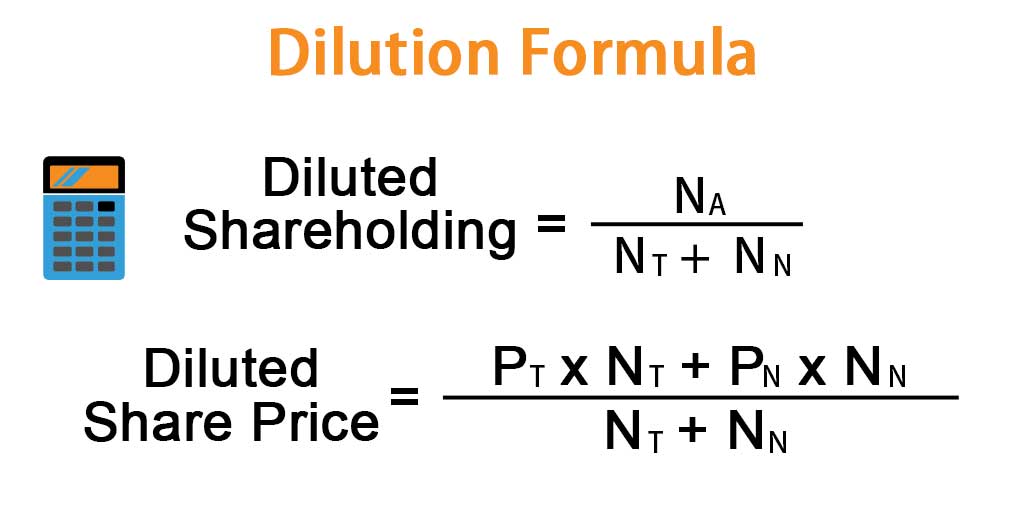

Dilution Formula Calculator Examples With Excel Template

Fixed Charge Coverage Ratio Fccr Formula And Calculator

Startup Fundraising Calculator Ledgy

Shares Outstanding Formula Calculator Examples With Excel Template

Budget 2020 Esops Taxation Get A Breathing Space Budgeting Start Up Wealth Creation

Free Startup Equity Calculator Evaluate Your Equity Offer Carta

Chain Discount Calculator Template Excel Xlstemplates Discount Calculator Excel Templates Templates

Stock Split Formula Google Example And Excel Calculator

/dotdash_Final_Weighted_Average_of_Outstanding_Shares_Oct_2020-01-4f04f4b373de45dea110be8462c0bf58.jpg)

Weighted Average Of Outstanding Shares Definition